Summary 1/11/2016

Arthur Cashin – Volatility is Back!

Echoes of 1937

Former Fed Governor Richard Fisher’s thoughts on stock market direction in 2016.

Dalio – One or two rate hikes in 2016? and then QE4??

I will gladly pay you Tuesday for a hamburger today.

– J . Wellington Wimpy

Volatility

We have been talking about the return of volatility since June of last year. In our June 2015 blog post titled Tick Tock we noted that the first half of 2015 had been one of the dullest in history. Sensing the end of the Federal Reserve’s zero interest policy we knew that volatility was sure to make a big comeback. In fact, Federal Reserve officials had been warning of just such an occurrence.

We should expect volatility from time to time. We are in a period of some uncertainty. -Esther George Kansas City Fed President Jackson Hole Economic Symposium

It was as if volatility had been banished to the waste bin of history by Central Banks. Well, we know things are never different and that volatility had to return with the advent of a change in central bank policy. That new central bank policy came courtesy of the United States central bank – the Federal Reserve. The Federal Reserve made the decision on December 16 of last year to begin the process of trying to normalize interest rates and hiked rates for the first time in over seven years.

Our good friend Arthur Cashin, a 50 year veteran of the New York Stock Exchange (NYSE) is a wealth of market knowledge and has an amazing array of friends to call on for their market research and insight. Arthur has probably forgotten more than most will ever know about market history. Last month Arthur pointed to Sam Stovall’s research on volatility during rate hikes. Sam Stovall is the Chair of S&P Capital IQ’s investment committee and has a tremendous track record of insightful research. I read everything that passes across my desk with Sam’s name on it.

In the past 50 years, it has been fairly common to see volatility rise, especially after the start of rate-tightening cycles. Indeed single-day closing price volatility saw an average 77% jump during the three months after the first in a series of rate hikes since 1967. In the three months prior to the December 16 rate increase, the S&P 500 experienced 21 days of closing price volatility in excess of 1%. History therefore implies that things could get even choppier in the months to come.

Yet this increase in daily volatility has occurred within a very narrow 52-week high-low price range. At 14%, this differential is 8th lowest since WWII. History shows that those years with narrow high-low ranges recorded the worst next-year price performances and frequencies of advance. In other words, 2016 will likely endure increased volatility, but without much in the way of price appreciation to show for it.

1937

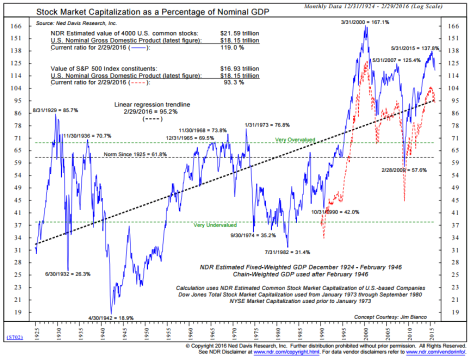

Over the course of the last seven years it has been our contention (and the contention of those far smarter than I) that Federal Reserve monetary policy was responsible for the rapid rise in asset prices here in the United States. Federal Reserve policy is directly correlated to that rise and is in fact a stated goal of the central bank. Federal Reserve governors felt that a rise in asset prices would engender confidence in the economy thereby inspiring spending on new projects and help reflate the economic engine of growth. Former Dallas Fed President Richard Fisher was on CNBC last week and explained just how and why the Fed enacted that policy

The purpose of zero interest rates engineered by the FOMC, together with the massive asset purchases of Treasurys and agency securities known as quantitative easing, was to create a wealth effect for the real economy by jump-starting the bond and equity markets.

QE3 and its predecessor rounds front-loaded the equity market. Stated differently, I believe we engineered a version of the “Wimpy philosophy”: We gave stock-market investors two hamburgers today in exchange for one or none tomorrow. We pulled forward the price-reaction function of markets.

If that is a correct assessment, then there may well be a payback period of lesser movement in stock prices to follow.

– Former Dallas Fed Pres Richard Fisher 1/5/2016 CNBC

Whether that policy worked is a point of contention but having realized the gain in asset prices with the expansion of the Federal Reserve balance sheet what is to happen when the Federal Reserve changes course? We would expect that asset prices would also begin to change course. This is what we had to say in our Quarterly Letter back in April 2015 about the last time Federal Reserve officials were faced with this dilemma.

It has been our contention since the dawn of the crisis that central bankers would be faced with the same dreaded decision that was faced in 1937. 1937 was, of course, 8 years after the Stock Market Crash of 1929 and seen as THE seminal moment when officials made the Depression – Great.

In 1937 officials began to pursue tighter monetary policies as the stock market had seen significant gains from its lows in 1931 and they feared another bubble forming. Our contention is not that policy was too tight in 1937 but rather that it was tightened at all. Monetary policy has its limits and we are seeing those limits now much as officials saw them in 1937.

The similarities are staggering.

As a reminder, so you don’t have to go look it up, 1937 was one of the worst years ever for the stock market. The Dow Jones was down over 32% in 1937.

After seven years central bankers have gotten absolutely no help from politicians and now the Federal Reserve is worried that if the next crisis appeared with interest rates at zero they would have no policy response.

“The Fed is a giant weapon that has no ammunition left.”

Former Dallas Fed Pres Fisher 1/5/2016 CNBC

What Next?

The Federal Reserve is on record as stating that they plan on raising interest rates four times in 2016. The market is currently pricing in two interest rate hikes. Who is correct? Seasonally, this is one of the stronger periods for the market and yet we have seen a 6% selloff in the S&P 500 in just the first six trading days of the year. That is the worst start to a market year in history. The Federal Reserve may have to change course rapidly if there is a break down in asset prices or a credit contagion that begins to form around the world.

Could Fed policy cause a recession in 2016? The Fed cannot abort the business cycle. If it does not come in 2106 it should not be long after. Recessions are a natural course of the business and market cycles. We accept them and invest accordingly. In recessions the US market has averaged a 38% decline over the last 100 years. We are late in the cycle.

However, while asset prices are high any move lower in asset prices will most likely be met with support from governments. Deflation is a government’s worst nightmare and they will do anything to prevent this. Russia, Japan and Brazil are already in recession and Canada and Korea are very close. The next weapon and possibly the last weapon in the Fed’s arsenal is direct debt monetization. Directly financed government spending known as “Helicopter money”.

We believe as much as Ray Dalio does, the billionaire founder of Bridgewater Associates, when he said in August that he believes that the Fed will reach back into its back on monetary tricks given a disruption in markets much as happened in 1936.

“We don’t consider a 25-50 basis point tightening to be a big tightening,” Dalio wrote in a LinkedIn post. “While we might see a tiny tightening akin to what was experienced in 1936, we doubt that we will see anything much larger before we see a major easing via QE.”

Defaults in the high yield market are starting to spread as may counterparty risk. This will be exacerbated if Saudi Arabia continues its oil supply policies. Capital has been poorly allocated in the oil patch due to Federal Reserve o% interest rate policies. Now Saudi Arabia is putting the squeeze on shale oil producers here in the US but maintaining higher than necessary supply levels. How long can the Saudi’s afford to pressure US shale producers? We don’t know but when their polices change it will be with less producers around producing less oil which in turn will produce higher oil prices.

A struggle may be coming as the US changes course on interest rates and emerging economies and governments struggle with paying US denominated debt. That may spill over to developed markets and banks. We believe that we here in the US have less to fear as authorities and banks have spent the last 7 years rebuilding the balance sheets of US banks. Europeans however, have not. They may have more to fear of an emerging market debt crisis.

We need to adjust our investing to the current winds. We foresee 2016 as being a tactically driven year. We feel that changing our positions tactically with the ebb and flow of the market, decreasing the volatility of our portfolios by increasing positions in bonds and bond like instruments while also paying attention to companies that have pricing power like technology and health care will be the key to performance. Cash also becomes an important part of asset allocation because it is the only way you can mitigate the correlation breakdowns we are going to go through, at least until the Fed enacts the next Quantitative Easing when cash will become a burden.